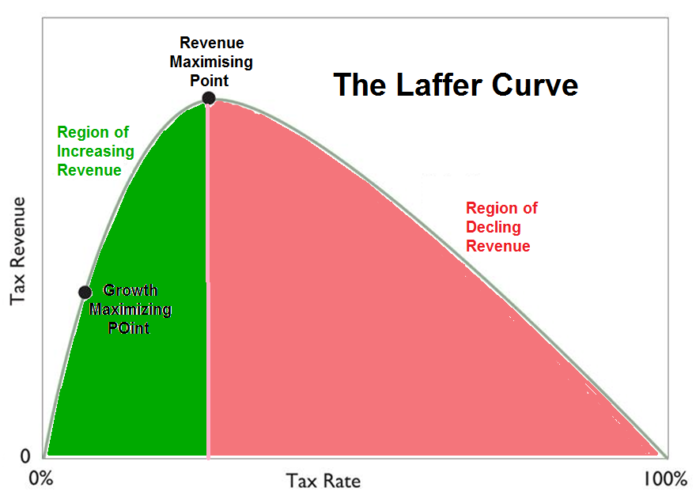

At a 1974 dinner meeting that included Dick Cheney, and Donald Rumsfeld, Arthur Laffer presented his case against President Ford’s tax increase by famously sketching a graph on a napkin to prove his point. This graph came to be known as the “Laffer Curve”

The Laffer Curve shows the direct correlation between tax rates and tax revenue. The graph suggests that there is an optimal tax rate where tax revenue can be maximized. To better understand the graph you have to understand what placing the tax rate on either end of the spectrum would mean. If the government imposed a tax rate at 0% the government would not collect any revenue. If the government imposed a tax rate at 100% individuals would no longer work, and businesses would no longer produce goods as there would be no incentive to do so. While there are varying schools of thought from economists where the tax rate should be placed, economic principles show that lowering the tax rate gives more of an incentive to produce

We are finally seeing the Laffer Curve applied in real policy, as well as the predicted results. The new GOP Tax plan has significantly lowered taxes and resulted in increased tax revenue.

The January 2018 Monthly Treasury Statement showed that the U.S. Department of Treasury received $361 Billion in tax revenue. In January 2018, the Treasury received $212 billion in individual income taxes, $113 billion in payroll taxes, $13 billion in corporate income taxes, and $23 billion in other taxes. For January, it was the most tax revenue collected in American history.

Furthermore, taxes received in the first four months of fiscal year 2018 (FY18) are also the most in American history. Thus far, tax revenue for FY18 have come from $603 billion in individual taxes, $372 billion in payroll taxes, $76 billion in corporate taxes, and $81 billion in other taxes.

A group of 137 economists pledged their support of the GOP Tax Plan in a letter to congress. In the letter, they cited a GDP boost and tax revenue increases.

“The enactment of a comprehensive overhaul – complete with a lower corporate tax rate – will ignite our economy with levels of growth not seen in generations. A twenty percent statutory rate on a permanent basis would, per the Council of Economic Advisers, help produce a GDP boost “by between 3 and 5 percent.” As the debate delves into deficit implications, it is critical to consider that $1 trillion in new revenue for the federal government can be generated by four-tenths of a percentage in GDP growth.”

The Laffer Curve was first drawn on a napkin, now we are seeing it be applied to tax policy. In the short-run the GOP Tax Plan has shown that Arthur Laffer’s analysis was correct that lowering taxes would raise revenue. In the long-run, there is optimism that tax revenue will continue to increase and that the American economy will continue its growth.