My last post was on our debt-based money supply, and this post will build on that by comparing our current monetary system to other systems of money. If you have not already read the post on our debt-based money supply, I would urge you to do so (both it, as well as this post, are quick reads), as this post assumes that the information in it is understood. I also need to define the term ‘money,’ and for the purpose of this post, ‘money’ will refer to any agreed upon medium of exchange.

Barter is not a monetary system so much as what emerges when there is no agreed upon medium of exchange, and the problem with barter is that it is grossly inefficient. Having an agreed upon medium of exchange greatly enhances the efficiency of an economy, and while there will always be some room for people to barter, our economy is far too big and vibrant, to try and go without an agreed upon medium of exchange.

Paper money first came into existence during the reign of Pharaoh Kufu, in ancient Egypt, who paid pyramid workers in beer. Beer seems like a strange thing to pay workers in, but Giza is in the desert, and the beer of the time had just enough alcohol content to prevent it from going bad, as often happened to water, when stored. Workers would get paid in beer, and then would trade some of their beer for all of the other things they and their families needed to survive.

At some point, Pharaoh’s scribes decided that they would stop physically giving out beer. They began writing paper chits that could be taken by workers to the storehouse and exchanged for beer (making the workers get their own beer), and it did not take very long before people began holding onto their chits and trading those. Paper money was born.

At some point, Pharaoh’s scribes decided that they would stop physically giving out beer. They began writing paper chits that could be taken by workers to the storehouse and exchanged for beer (making the workers get their own beer), and it did not take very long before people began holding onto their chits and trading those. Paper money was born.

Beer is consumable. The amount of beer in existence can vary a great deal over time, and as such, beer proved to be less than perfect as a monetary base. Egypt, and then other societies, began to experiment with different commodities to use as a monetary base. Gold never breaks down, and never tarnishes, so over time gold became the favored commodity, and when people say that we should get rid of the Federal Reserve, they usually suggest that we move to a gold standard.

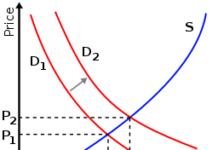

Imagine what happens to the value of money, on a gold standard, when a gold rush occurs. The amount of gold in circulation suddenly changes very quickly such that nobody can know, with any certainty, how much gold either is in circulation, or will be in the near future. Speculation then will run rampant, and the value of gold (and the dollar) will gyrate, destroying the efficiency of the dollar as a medium of exchange, and causing a recession.

If a government prints too much paper money, relative to the country’s gold holdings, people will start to lose faith in the value of money, and will transfer their money into gold in large numbers. If the country runs out of gold before it has transferred everyone’s money into gold (all those who want it transferred that is), it’s currency will collapse in value, causing a recession.

The gold standard caused a lot of recessions.

Whenever the value of the dollar changes by a significant, unknown amount, the economy will go into recession.

Countries have also used fiat currencies (money not backed by anything), and in fact, both the Revolutionary War, as well as the Southern part of the Civil War, were paid for using fiat currencies. Fiat money only has value if people are willing to accept it, and both Continental Currency as well as Confederate Currency were often said to ‘not be worth the paper they are printed on.’ There is no such thing as a ‘run’ on a fiat system, but that is only true because under a fiat system, there is no commodity to for people to run to, should too much paper money be printed. Fiat systems are not only prone to recession, but to complete failure.

People say that it would be impossible to return the United States to a gold standard, as there are so many dollars floating around the world that there would never be enough gold to base the dollar on. That’s not true, and in fact, as I showed in my previous post, other than the $861 billion dollars we have in paper and coin currency, all of the other US dollars in circulation are backed by the need to perform labor to repay debt. If we wanted to back the dollar with gold again, we don’t need to worry about the roughly $100 trillion electronic dollars in circulation. We only need to worry about the $861 billion in paper and coin currency, and there is plenty of gold to back that! If anything, our problem is that we don’t have enough money to back it in gold – to have a viable gold standard we might have to print more paper and coin currency.

Actually.. There would be another problem, should we ever decide to go back to a gold standard, and I don’t want to trivialize it. We would also have to worry about a run on our currency, should a large number of people decide that they would rather have gold than dollars. We could say that the Federal Reserve will only transfer paper dollars for gold, but that could cause a run on our banks, with people rushing to empty their checking and savings accounts. The treasury could print paper money and pay off federal debt, which would create more physical currency (protecting the commercial banks from runs), but that expands the threat of a run on our gold reserves. There would be no easy way to migrate back to a gold standard, but it is theoretically possible to do so.

It is also worth mentioning that we ran with both the Federal Reserve and a gold standard for more than fifty years (1913-1971), so going back on a gold standard would not necessarily get rid of the Federal Reserve.

What the gold standard does do is to prevent inflation, which in turn limits the government’s ability to run deficits.

This gets us back to the original post that prompted people to ask for more introductory material. That original post was on debts, deficits, economic growth, and inflation, as well as on how those things are interrelated. If you have read that article, then you’ll start to see why these subjects are so important for people to understand. Understanding how these sorts of things relate to one another changes not only how someone votes, but how they think, when it comes to politics. Liberals have a major leg up on us, controlling our schools and universities. Liberals are quite literally the ones teaching our children what to think. If we cannot change how people think, by exposing them to the truth, we lose. It’s as simple as that.

I don’t mind writing introductory economic articles. If you would like me to write more, please comment below. Don’t make suggestions in Facebook, as I might not see them. If you would like to suggest a topic, please make the suggestion here.

As always, if you enjoy this post, please help to spread our message, by sharing far and wide. For your convenience, we have share buttons below.