Prior to the New Deal era in the 1930s, the US was a very basic societal arrangement. While there were (and always are) small numbers of the super-rich (for the day), the overwhelming majority of people had very simplistic methodologies to survive. There was no formal ‘social safety net’, so incentives were quite pure: work in some fashion to earn money to buy essentials—food, shelter, etc. Our society has changed quite a bit in the succeeding 90 years. But that coin has two sides. Let’s dig.

From its very inception, even pre-USA, America was the epitome of EARNED. People came from all over the world to participate in a rare combination of political, religious, and economic freedoms, coupled with an untamed wilderness, along with private property ownership. None of those elements could be removed from the equation, as each were essential to the magnetic draw of the US. People felt that their efforts and risk-taking would result in EARNING a better way of life. It was not an easy thing, and there were zero guarantees—in fact, the wilderness was quite dangerous, even life-threatening. Wild animals, Indians, lack of any type of law enforcement or medical assistance, and an unyielding landscape, all met the settler. Starvation, adverse weather, sickness of many kinds, were all potential outcomes. But even those dangerous prospects were viewed by many as a dramatic improvement over whatever situation they left. The idea that they, not some royalty or military figure, would benefit from their efforts, was enough of an incentive to warrant the dangerous travel to the New World. Many came with little or no money, and only whatever they wore or could carry. The pure guts needed to make that journey, leaving familiarity and family, to go to a completely unknown environment, was considerable. And still they came.

As towns and villages popped up, civilization took small steps to improve. The gathering of people to a similar locality had many advantages. Law enforcement, banks, medical folks, dry goods stores, saloons, butcher shops, even groups of folks (that were not family) to assist in home and barn raising, all were a product of collective people. If you help folks, they may help when needed, in the future. Not a defined ‘social safety net’—no one got paid to do nothing—but a mutual assistance arrangement. Each function matured over the years, especially as populations grew. With enough people, folks could specialize in various trades, with money earned and spent based upon the community value of those trades. It was nearly pure Capitalism: no boundaries to business creation, just the efforts and visions of those attempting new enterprises. Many such endeavors failed, but many succeeded. As more such towns grew to become cities, a nation raised itself from infancy to adulthood.

Fast-forward to the 1930s. Up until this time, assistance for those in need was purely a local affair. Churches usually took the lead, offering soup kitchens for the hungry, sometimes including shelter for the needy. But the Great Depression changed the scope of ‘needy’. Over 25% of the workforce was considered unemployed. The causes and effects of the Depression have been chronicled and debated in the decades since, but the one thing almost everyone agrees upon is that the economy was terrible. The lines for the soup kitchens were long and constant. Other than local farmers that could grow their own food, many people in cities faced possible starvation. The Social Security Act of 1935 was an attempt to alleviate many facets of the misery, from a Federal government standpoint. Included in this legislation was retirement income for the elderly (Title I), unemployment compensation (Title III), aid for children (Title IV), and several other specific areas. For the first time, Welfare programs existed at a Federal level. That is, folks that had no job, or the potential for a job, received a minimal stipend from the Federal government. Additional support came from other legislation: SNAP (food subsidies) is part of the Agriculture Department; rent subsidies are part of Housing and Urban Development, and so on. Pertinent to this article, for the first time, Federal government created programs that required no work incentive to receive benefits. Note that these benefits were not ‘free’, it is just that the taxpayers, as a whole, pick up the tab. The money to fund such programs began back in 1913, with the ratification of the 16th Amendment to the US Constitution: Income Tax.

Originally, Welfare benefits were quite meager: food and rent subsidies were the bulk of benefits received. There were disbursements of agricultural products, such as cheese and peanut butter, that not only provided food assistance to those that needed it, but helped maintain the market prices for those items. Direct cash benefits were rare. The incentive was for Welfare recipients to seek and find work, thus removing their need for Welfare. Welfare was intended to be a true ‘safety net’, to catch those that fell through society’s ‘cracks’. Not many were expected remain on Welfare for any long duration—it simply did not provide for much of a lifestyle, just minimal sustenance for those in short-term need.

Over time, Welfare changed, and people changed along with it. Food distribution gave way to check payments. Technology allowed for cash disbursements to checking accounts or ATM cards. Surprisingly or no, some folks became accustomed to the Welfare system. The major motivators of hunger, shelter, and even social stigma, eroded over time. Unfortunately, along with those erosions went the ability to find and maintain a job—or even the desire to do so. Why work a minimum wage job when funds can be had for doing nothing? The incentives to work entry-level jobs for many such people disappeared entirely. We now have multiple generations of Welfare recipients—grandparents, parents, and children of the same family, with none possessing the skills necessary to become productive citizens.

Now we add the last part of this dynamic: immigration. Remember, prior to the early 1900s, the US had no real immigration policy. If you could get here, you were welcome. But, since there was no ‘safety net’, you had to work to survive, since no programs were in place to assist you. For some, that meant nearly slave labor, either in fields or sweat shops, doing hard, menial work that paid little. But little pay was better than no pay, especially when food was involved. The ultimate incentive: work to avoid starvation.

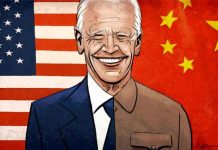

Current day policies collide with each other. Immigration now comes in two flavors: legal and illegal, both with their own problems. The legal system is way too cumbersome, and takes years and thousands of dollars to perform a simple function: make someone from another country a legal US citizen. Unless your goal is to create a cottage industry of immigration lawyers, it is an antiquated, nearly failed system. The illegal immigration system may actually be worse. Those that choose to avoid the legal system can enter the US via thousands of miles of common international border, both with Canada and Mexico. There are also Visa overstays, where students and temporary visitors get ‘lost’ into US society. The risk there is that it simply is not legal—not quite the same stress as our early settlers. Political positions vary greatly—some want the border policed and maintained, others really do not want a border at all. And those that choose to enter illegally stand a reasonable chance that legislators will grant them amnesty—rewarding the illegal by letting them ‘jump the line’ ahead of those in the legal process. Either way, legal or illegal, the immigration system hits the Welfare system head-on: should immigrants, that have not paid taxes into the system, gain taxpayer-funded benefits? Everything from Welfare to retirement benefits fall into this category.

Back to incentives: the US Welfare state is an incredible incentive for immigrants to change countries. As much as a disincentive Welfare is to entry-level workers, it is quite the stimulus to third-world people, sometimes fleeing abject poverty, political strife, and persecution. Some are even criminals, both in their original and new countries. What would the incentives to legislators be to allow this flow to continue? Some want new immigrants for a new voting bloc, as most are perceived to want and vote for more government programs. Some want new illegal immigrants as a near-slave labor pool, where companies can pay sub-minimum wage rates, usually in cash (or, with fake or stolen social security numbers). The unavoidable stress illegal immigration puts on the US education, prison, medical, and ‘safety net’ systems is very real, and very expensive. Once again, the US taxpayer foots the bill for all expenses. And the taxpayer is a captive payor—incentives are not required. Whether the taxpayer can continue to pay for all of the poor, disenfranchised, and persecuted people of North, Central, and South America remains to be seen. That such unfettered immigration, coupled with a taxpayer-funded social safety net, is unsustainable is almost a dead certainty.

Welcome!Log into your account