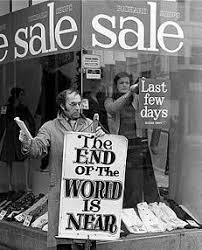

We may be seeing the confluence of four major economic events in the next few months…

I try to observe Economic trends. It amazes me how pure Economics explains many phenomena, and even predicts some future pricing events (as price is the most accurate reflection of Supply and Demand). When something independent of the market hits (most often severe weather or governmental action), the markets try to adjust to correct. Sometimes, it is price-gouging of drinking water after a tornado; sometimes, it is a decrease in retirement savings after the government implements Social Security. But sometimes, the market, due to such outside forces, flat-out fails. And I think we are on the edge of a quadruple threat to our lives. Let’s dig.

The first threat is quite obvious: the almost complete elimination of Demand for many goods and services, due to the governmental reaction to COVID-19—the complete shut-down of several parts of our economy. Travel, hospitality, restaurants, and most service industries (the so-called ‘non-essentials’) have felt the smashing effects to their businesses. From a robust Demand economy to an almost complete stop, takes an incredible market force to correct. Note that many businesses forecast plant spending, hiring, expansion, and future plans on the economy prior to the shut-down. If the shut-down stays in effect for much longer, hitting those forecasts is likely impossible. For many, their spending is already done, with little likelihood of recovery with such reduced revenue.

The second threat is brutally evident: instant unemployment, caused by the first threat. Over 26 MILLION people filed for first-time unemployment benefits in the last 4 weeks! From 3% unemployment to a truly scary number (likely in the 20-30% range) in a month. Not only does this put an outrageous strain on the entire unemployment benefit process, it takes millions of folks from taxpayers to tax receivers. The impact on 941s (quarterly income taxes paid by small businesses) will be reported soon. It is not going to be pretty.

The third threat is to domestic food production. Reports have been posting about milk producers destroying milk because there simply isn’t enough Demand for their product—especially with school closures. Beef, pork, and chicken ranchers are feeling the same pinch due to restaurant closures. Yes, there are home purchasers, and some restaurants are operating as curb-service entities, but the first is already baked into the Demand expectations, and the second is a sliver of normal, with companies operating at a steep loss, just to retain key personnel. Reports of meat processing plant closures are not a rare thing anymore. Similarly, farmers have been attempting to sell produce out of trucks, as there is no demand from their normal distribution channels. Some have destroyed crops in the fields and euthanized livestock, as harvesting and processing is are more expensive than not selling. The last is the scariest part, because those decisions require SEASONS to recover from, if the farms and ranches even stay in business.

The last threat is sneaky: the impact to our currency to try to ease the pain of points two and three. The Federal government spent or loaned over $2T of currency, with zero economic activity to base it upon—basically, they just cranked out the printing presses. This will devalue every single dollar already in circulation—the very definition of inflation. And the government is likely not done with such programs yet.

The net effect of all four of these threats combined? Not good, on any level. There is the slight chance of alleviating some of the pressures by reopening our economy. Not sure the mechanics of how it would be done, but the service industries would at least get back to serving, returning to taxpaying status. The lines at nail and hair salons may get extreme! But the restaurant and sporting events sectors may be slow, maybe months or years, to recover to January’s levels. Cruise ships may NEVER recover, as consumer confidence may never overcome the ‘caught at sea’ images. Air travel may rebound, but many companies have found telecommuting as a better answer than physical travel. But the very scary scenario is the disruption or destruction of our food service creation and distribution systems. Any guesses what the prices of reduced supply of foods available for sale will be? We complain when ANY price goes up, but we may be in uncharted territory here. $20/pound ground beef? $20 whole chickens? It may get very ugly, very fast, this winter. Geez, I hope I’m wrong.