“The first object of taxation is to secure revenue. When the taxation of large incomes is approached with this in view, the problem is to find a rate which will produce the largest returns. Experience does not show that a higher rate produces the larger revenue….

“I agree perfectly with those who wish to relieve the small taxpayer by getting the largest possible contribution from the people with large incomes. But if the rates on large incomes are so high that they disappear, the small taxpayer will be left to bear the entire burden.”

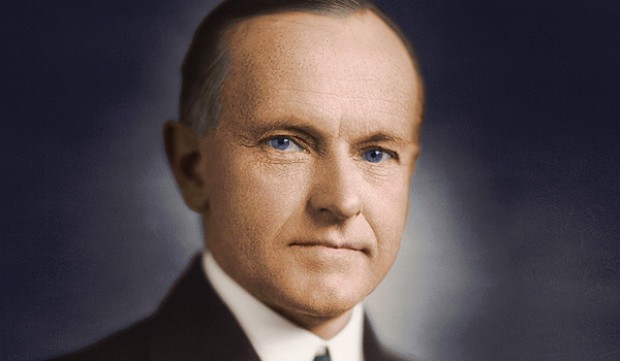

—-Calvin Coolidge

Calvin Coolidge said this after sharp tax increases between 1916 and 1918 reduced the taxable incomes of those making over $300,000 a year (the 1% of his day) by half. The revenues raised from this segment of the population also dropped by half.

According to Thomas Sowell, there were 206 people reporting incomes of a million dollars or more in 1916. Taxes then shot up over the next several years. There were 21 people reporting incomes of a million dollars or more in 1921 – not because the richest Americans made less money than before, but because they moved their incomes to tax shelters and to tax-free municipal bonds.

Taxes came back down from 1921-1925, and by 1925 207 people reported incomes of a million dollars or more.

When tax rates are too high, those with means move their wealth to low-performing tax shelters, to avoid paying the high taxes. When rates are lower, they can make more money investing where they can earn a higher return. For the rich it is an easy question – do tax rates translate to higher returns investing in the economy (where they can get a higher return but will be taxed), or in tax shelters (where they will earn a much smaller but tax free return).

Taxing the rich at prohibitive rates is an emotional game. It raises no tax revenue, and historically reduces the proportion of taxes paid by the rich. That means that a higher burden of government must be borne by the rest of us.

Democrats tend to go with the emotional argument – arguing that lower rates benefit the wealthy. There are exceptions, such as John F. Kennedy, but I have never, in my lifetime, heard a Democrat in office speak in favor of lower taxes. Democrats like to call tax cuts ‘hand outs for the rich,’ in spite of the fact that all available evidence (including the fact that 47% of Americans pay no federal income taxes) proves how tax cuts reduce the tax burden on the poor.

Republicans generally go with the logical argument – that relatively low tax rates increase tax revenues, giving government more money to spend on such things as social programs.

If you look at tax rate cuts in history, whether you look at the cuts in the early 20s, in the early 60s (under JFK), in the 80s (Reagan), or in the 2000s (G W Bush), the same thing happened in all cases – either an immediate boost in tax revenues, or a modest drop immediately after the tax cuts, followed by significant gains in tax revenues each year thereafter, as people adjusted to the new incentives.

More recently, Donald Trump’s tax rate cuts increased tax revenues as well.

Kennedy and Reagan doubled tax revenues by lowering tax rates. Bush’s tax cuts did not double tax revenues, but revenues did grow significantly after the first couple of years – and if you look at his deficits you will see that before the recession of 2008 the deficit his tax cuts initially caused was almost gone, in spite of two ‘unfunded wars,’ and a major increase in Medicare benefits.

In other words, we paid for the increases to Medicare benefits, as well as two wars, by cutting taxes.

We can debate what caused the recession (as well as how bad it actually was) but it was not caused by tax cuts.

As for ‘trickle down’ – when George W. Bush left office, the proportion of the tax burden paid by the wealthiest Americans was the highest it had ever been in the history of our nation. If the rich pay more, it should go without saying that the rest of us can pay less, and particularly when 47% of our public pay no federal income taxes at all.

That is not to say that tax cuts will always increase revenues. It goes without saying that rates of zero raise no revenues at all, so it is obviously possible to lower rates too far, but we are not at a point, today, where we can say that tax rates are too low. We know this because Trump’s tax cuts did not reduce tax revenues.

When taxes are reasonable, rich people put their money where they can get a return. This generates economic growth, and it makes their wealth taxable. When taxes are too high, rich people put their money into poorly paying things like municipal bonds, that are tax free. That money generally gets wasted, and we get no tax revenue from it.

If Calvin Coolidge was correct, and ‘the first object of taxation is to secure revenue,’ then the course is clear: we need to set rates where they maximize tax revenues over the long term, which is also where they maintain high rates of economic growth.

Republicans like low tax rates, and Democrats like high tax revenues. Given that relatively low rates create higher revenues, one would think our political parties would be in agreement, yet they are not. Perhaps that is because Democrats (at least the ones in office) are not interested in raising tax revenues, so much as in raising government control.

When the time comes, we need to vote them out of office.