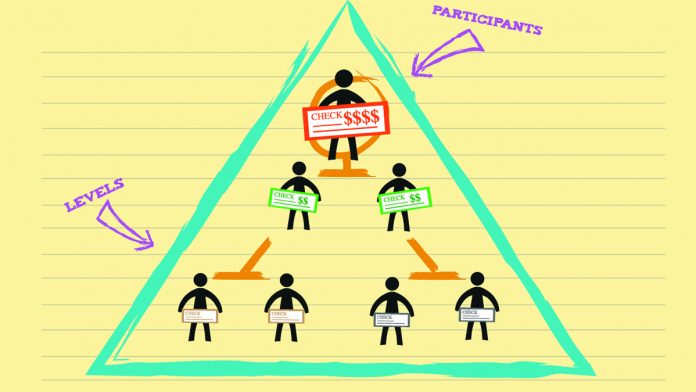

There are two ways a state can provide for its elderly. One of them is to take some of the income from those who are working, and to give that income to those who have retired. The other way is to mandate that those who are working take a proportion of their income, and invest it for their own retirements.

As a libertarian, I must point out a third option – to keep government out and let workers fund their own retirements without a mandate. Politically, this option isn’t viable. Right, wrong, or indifferent, the public expects government to provide retirement income to our seniors, so this article will focus on the two types of government programs mentioned above: 1) transfer payments from workers to retirees, and 2) forced individual retirement savings.

Both types of programs involve risk. If you take income from those who are currently working to support those who are not, then the number of workers you have for each retiree becomes a very important number, and if you end up with too many retirees, and too few workers, the system will implode. If each person is forced to save for their own retirement in private accounts, some of those accounts may do poorly. If recession hits just as some people are getting ready to retire, they may lose a significant portion of their retirement income, and may have to choose either to work until their savings rebound, or to retire on less than planned. If we do not mandate anything (the third option), there is the risk that some people will have nothing to retire on at all.

There are many ways to mitigate risk. There is not much that can be done about an aging population. If we don’t have enough children to support each new generation of retirees, any social security program based on a direct transfer of income from workers to retirees will fail. With private programs, on the other hand, government could guarantee a minimal level of income, and could pay for that minimum by taxing the retirement benefits of those who do particularly well.

Many Americans believe that we have a hybrid Social Security program, in which each generation pays a portion of its income into a giant pool of Federal Savings Bonds, from which guaranteed benefits are then paid in retirement. That is, unfortunately, not how it works.

Franklin Delano Roosevelt signed the Social Security Act into law on August 14th, 1935, in the midst of the Great Depression. At the time, government taxed less than 5% of GDP, with a top marginal rate of 75%. Roosevelt had a real problem on his hands: he wanted to spend limitless amounts of money on his New Deal, and there were not enough rich people to pay for it, even with a top tax rate of 75%. Roosevelt could not raise taxes on the poor or middle class in the middle of a depression, so what was he do to?

Answer: Social Security.

It is true that Social Security invests into Federal Savings Bonds, but what are Federal Savings Bonds? They are, of course, government debt – a vehicle government uses to spend money today that it intends to tax tomorrow. When government imposed a 7% Social Security payroll tax in 1935, there were no retirees drawing from the program, so 100% of the revenues were ‘invested’ into Federal Savings Bonds. With a government that was only spending 5% of our GDP, we were not producing anywhere near enough Federal Savings Bonds to meet the new demand for debt. Luckily, FDR had a solution to that problem: government could spend 7% more of our GDP to fund his New Deal programs, creating the federal debt Social Security needed to ‘invest’ in. Just like that, tax revenues more than doubled, and since the payroll tax was capped, the poor and middle classes took the brunt of the hit.

What was the effect of more than doubling taxes in the middle of a depression? The depression continued until World War Two, four years later. The New Deal did not help. If anything it prolonged the depression, which is what one would expect – only an idiot would think it possible to tax a nation out of a depression.

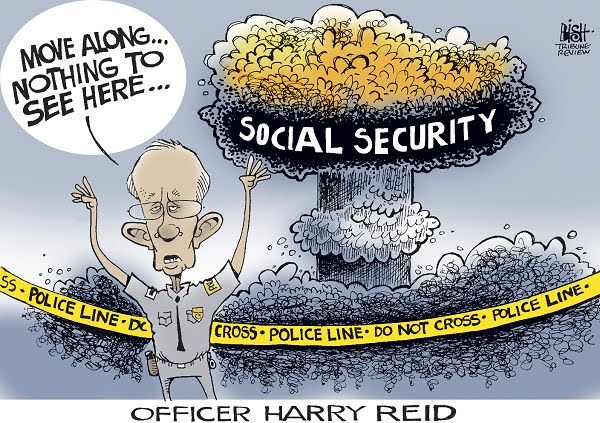

The notion that Social Security ‘invests’ in anything is a shell game. When Federal Savings Bonds mature, we don’t go back in time and tax the people who were working when the bond was written to pay it off; we tax those who are working when the bond is cashed in. When the Federal Government is holding it’s own bonds as an ‘investment’, that’s like someone paying a credit card bill with another credit card. What’s more, since the government had to create the debt before it could ‘invest’ in it, it’s like someone supporting their family using credit cards, and using other credit cards to pay their credit card bill. There is no investment involved – all proceeds are spent as quickly as they are received, and all that is left is a pile of debt.

In 1945, there were 42 workers for every retiree, and the retirement age was beyond the life expectancy, so most people were never paid anything back. In 2015, there were 2.8 workers per retiree, and the retirement age was much lower than the life expectancy. To put that into perspective, today’s workers have fifteen times the same burden as did their grandparents and great grandparents, to support Social Security. That ratio is only getting worse, going forward.

If we wanted to go back to FDR’s program, we’d have to raise the retirement age to 80, such that most people die without ever receiving benefits – as they did when the program was created.

Chile has the other form of Social Security, with individual accounts. The promised rate of return is five times what our Social Security system pays, and Chile recently had a recession representing the ‘worst case scenario’ critics of private program fear. Even in the midst of recession – when all of the worst case risks came true – Chile’s system still paid three times the return on investment our system pays. Better yet, in Chile workers live off of their own earnings when they retire, so this system works whether the working population is growing or not. This is a better system, and one FDR could have chosen to put in place had he wanted to.

Our seniors today are being short-changed. The average retiree gets just $1,290 per month. That’s $15,480 per year. Nobody can live off of that. Under Chile’s program, they would get $6,450 a month, or $77,400 a year to live on. Even in the midst of recession, our retirees, under a Chile-style program, could expect at least $3,870 per month, or $46,440 a year. Do you want to retire on $15,480 a year, or on $77,400 a year? Unfortunately, FDR made that decision for us, and he made it based on his own political agenda rather than based on our best interests.

More importantly, the payroll tax sucks up a whopping 13% of a worker’s income, choking out a worker’s ability to make private retirement savings.

Our seniors deserve better than the starvation wages our Social Security system provides. Transitioning away from the current system would not be easy though – seniors survive on their benefits, and for many retirees, that’s the only income they have. It would be worse than heartless to cut them off. Many others have reached an age where even though they are still working, their ‘investment’ into Social Security already has them reliant on this system for their own future retirement. Those who are already invested deserve their promised returns, and since Social Security has no real trust fund (it is just a pile of debt), someone is going to be taxed to pay for those benefits in the future. Over time, however, we can get out from under this program, and can start to pay our seniors a far better rate of return – as they deserve.

The solution is to continue paying Social Security for all workers over a certain age (some say 40 – I’ll leave the exact age open for debate), and to take the wages of anyone younger than that and force them to invest that money privately. The growth of these private investments can be taxed to guarantee current and future Social Security payments, and as those who draw from the current system die, the burden of FDR’s system will be reduced, allowing future retirees to keep more of their investment income.

Those under our cutoff age (I used 40 as an example) would receive some Social Security income based on the earnings they ‘invested’ in that program, and will also receive income from their forced private investments.

Everyone would receive at least what the current Social Security system guarantees.

Sadly, such a program will never become law in the United States. The political left is firmly against any form of privatization, and many on the right are so much against government mandates that they are unwilling to replace a horrendous mandate with a less-bad one.

As such, bad as our current system is, it will continue unless articles like this one can change public opinion on the left, and the right.

[…] about Social Security? If our seniors had invested the exact same money privately, they’d get five times the retirement pay they currently get. Thank you progressives for short-changing our […]

[…] about Social Security? If our seniors had invested the exact same money privately, they’d get five times the retirement pay they currently get. Thank you progressives for short-changing our […]