I originally wrote this article on my personal blog, back in 2017, under the title, “Inflation, Gold, and Taxation.” I’ve been asked several times, recently, about inflation, so I wanted to re-post this article on Global Liberty Media.

Not much has changed since 2017, so other than a few introductory notes, I’m posting the article as originally written.

In addition to being asked how inflation works, I’ve also been asked how I would invest, relative to inflation. That’s somewhat easy to answer if you think about how inflation works. I’ll add that note to the bottom of the article…

‘Gold is money,’ or at least so goes an old Austrian School saying. According to this view, the value of gold is relatively constant, and it is the value of money that changes over time.

For the statement ‘gold is money’ to be true on an absolute sense (rather than a relative one), the amount of gold would have to grow at the same rate as the world economy, and gold is a commodity mined from the Earth, so it’s value is not 100% constant, but gold is the best leading indicator of inflation we have.

We can check to see how good of an indicator gold is by looking at the value of gold relative to central bank balance sheet holdings. If money moves around gold, then when the money supply expands, investors should buy more gold, and there should be a correlation between the price of gold and the supply of money. I’ve seen a lot of charts comparing the supply of US Dollars, or Yen, or Euros, or some other major currency, to the price of gold, and the correlation seems weak. Gold, however, is a global commodity, so to get a true view of the relationship between the price of gold and the rise in the supply of money, one would have to look at all money in circulation, using all major currencies. Here is that graph.

This graph should dispel any question regarding the cost of gold relative to the supply of money. If you are wondering where the Chinese Yuan is, it was pegged to the US Dollar (during the period this graph covered) and did not need to be included.

Inflation is not complicated. If we had an economy comprised of nothing but four dollars and four apples, each apple would cost a dollar. If we added four more dollars, but no more apples, each apple would cost two dollars. This is inflation, we see it in the cost of gold almost immediately, and it really is that simple. What is complicated is not the process of inflation, but the global economy it works through.

Gold is a leading indicator of inflation, meaning that as money supplies change, the price of gold follows almost immediately. Other precious metals, like silver, move next, and if we look at the price of silver (below), we can see that it too tracks upward, along a similar trajectory.

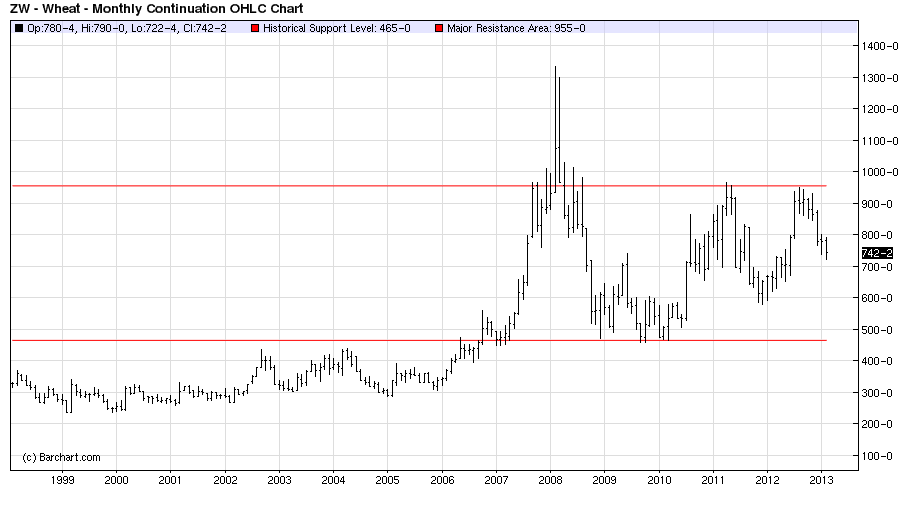

Eventually, non-consumable commodities begin to rise, such as iron ore. The price of consumable commodities, like butter, milk, eggs, and wheat (shown below) climb next.

Inflation can appear ‘transitory’ while it moves through commodities, but once an economy grows to the point where workers can tell their employers that they need a raise, suddenly the price of manufactured goods and services go up in price too. Commodity prices go up again as well, reflecting the labor needed to mine metals, to milk cows, to harvest wheat, and to bring commodities to market.

Workers respond by asking for yet more money, raising the costs of everything yet again. Workers respond yet again by asking for yet more money, raising the costs of everything yet again.

Once inflation hits wages, it appears to come in waves, until a new balanced price level is found.

Note that because labor is a trailing indicator, inflation hits workers much harder than it hits the rich. The rich can move their investments around to hedge inflation, and actually see the value of their investments grow while inflation works its way through the economy. Only after labor has caught up with the price of everything else do workers see any form of parity again – up until then, incomes stay flat, and everything workers buy costs more. Inflation is a hidden tax on labor.

Inflation may be the worst kind of tax, for it is terribly regressive, hitting the poor harder than anyone else, and not hitting the rich at all.

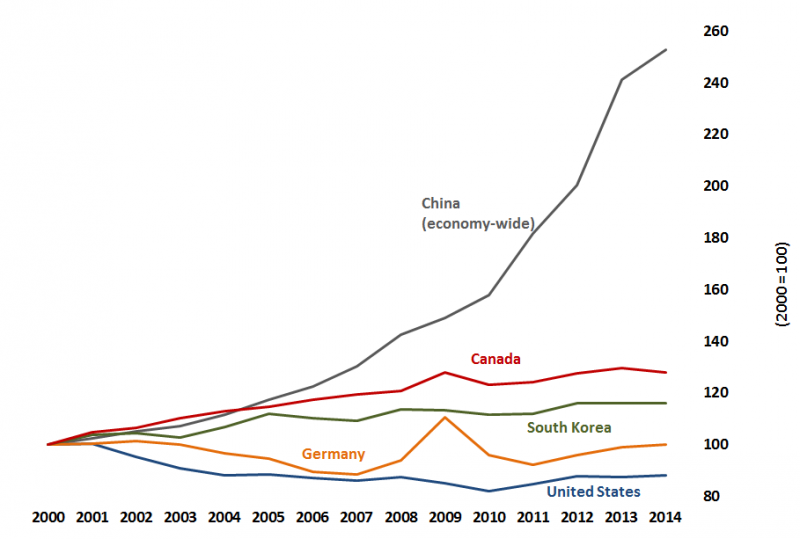

We live in a global economy, and labor is a global resource. When the price of labor begins to climb, it often climbs overseas before it climbs here. The chart above shows the cost of labor in the United States dropping, while the cost of labor in South Korea, Canada, and China is growing. The cost of labor in China is exploding. Why? Because labor is cheaper in China, so as the demand for labor grows, employers expand in China rather than in the United States. Wages will eventually go up here too, but not until companies can no longer utilize labor in cheaper countries quickly enough to keep up with demand.

The point to all of this is that everything we purchase costs more today, even though the American Worker is not getting paid more. We are currently poorer on an absolute scale than we were in the year 2000, and the reason is inflation.

When someone asks, “If expanding the supply of money leads to inflation, then we have expanded our money supply, so where is the inflation?”, the answer is, it is in gold, silver, wheat, milk, eggs, and everything else we purchase. Inflation is in wages in China and other developing nations – driving the cost of the iPhone up to $1,000. The only place we do not see inflation is where it will help the American Worker – in OUR wages.

And once our labor costs start to rise, hold onto your hats. It will be a bumpy ride.

I promised to add a note on how to invest, based on how inflation works. Now that I’ve described how inflation works, I can discuss investment strategies. Note that there is always risk when investing, and though I am giving advice, I cannot guarantee in any way that taking this advice will always work – these are highly generalized strategies.

In a nutshell, you want to invest in whatever is growing in value, relative to everything else, at each given point in time, during an inflationary cycle. When the supply of dollars is growing (‘Quantitative Easing’), gold is the obvious choice. Gold may actually rise too much, based on the expectation of a continued rise in the supply of dollars, so as the fed transitions away from a monetary expansion, it is important to move from gold into other commodities, trying to ride them as they rise, relative to other things: other precious metals, then in non-consumable commodities, and finally into consumable commodities.

It can take a long time before the cost of labor rises in the United States, but if you can invest in labor in a market where labor is rising in value, you can make money there as well. You don’t want to invest in industries that use labor though – you want to invest in companies that sell labor, such as headhunter firms.

As labor costs start to rise in developed nations (like our own), you’ll want to invest in labor in the developed world, again by investing in firms, like headhunter companies, that sell labor.

By investing in gold, as the supply of money grows, you are hedging against inflation, essentially moving your money into something that will retain its value as the value of the dollar drops. This gives you more dollars, but not more wealth. As the value of the dollar, relative to gold, stabilizes, and you move your money to other things, your real wealth will grow along with the value of those other things.

The danger in using inflation as an investment tool is that a rapid, unexpected change in the value of money can cause a recession, and as a consequence, as inflation works through an economy, it can cause a recession. This is particularly true once inflation hits labor. If that happens, and you get caught in investments that lose value, just remember that markets recover after a recession ends, and that your losses are not realized unless you sell. Simply ride out the recession (after ensuring you are properly diversified, such that you carry only market risk), and go back to your investment strategy after the market recovers.

So, what is the bumpy ride? A drop into recession?

That’s hard to answer without knowing what the Federal Reserve is going to do, but if you want a prediction, I’ll leave you with this:

https://globallibertymedia.com/the-award-for-the-biggest-threat-to-the-united-states-goes-to/