With “It’s a Wonderful Life” filling many living room TVs this holiday season, and the villain of said story is a banker, I’m reminded of a vigorous discussion I’ve had in years past about banking in general. Let’s dig.

If one were to only listen to Liberals or CNN/MSNBC (but I repeat myself), one would think that loan sharks exist legally, via the banking system. They depict banking as a cross between a drug dealer and Scrooge McDuck. Bankers are rich, evil, greedy, mean-spirited people, who control everyone’s lives, just waiting to foreclose upon them! If this is your view of the banking industry, and you wish to maintain that view, exit this article.

The banking industry exists as a hub of capital. Your local bank is a place better suited than your mattress for storing cash and valuables. They have VAULTS there, specifically for that purpose. They safely hold deposited funds, available to the depositors, in some cases, paying interest on those deposits. They then use the accumulated deposits (or a small portion of them) as backing to loan other funds to borrowers, charging interest for those loans. And some of these loans are mortgages, loans for real estate, with the property as collateral for the loans. The difference between the interest the banks pay for funds, and the interest paid by their borrowers, is the bank’s profit. Banks may also issue credit cards, which are unsecured loans, but with a higher interest rate paid on balances—but the risk of default of such instruments are part of that equation.

But many factors influence the banking industry. First, in the US, it may be the most regulated industry going. From fair-lending laws, to disclosure of terms laws, to how much risk they can absorb in their investments, banks have stringent rules they must operate by. And the fines for breaking those rules are HUGE. Many banks have tried their luck doing so, and paid LARGE penalties for that activity. Wells Fargo, Chase, and many others have been assessed multi-million-dollar fines. But the biggest constraint upon the banking industry is competition. There are so many banking alternatives to most folks, the choices are astounding. In many towns, a single intersection may contain 3 or 4 banks! Add to that the Internet-based banks, and the options abound. Don’t like the treatment or terms from bank A? Bank B, C, D, and whatever will gladly take your business.

Now for the term ‘predatory lending’. Ugh. Bankers are not out on the street, coercing people to enter into agreements they cannot afford. And with regard to mortgages (especially variable rate): do you not READ what you sign? Banks cannot force you to sign anything. Can’t afford a mortgage? Continue to rent.

PS: guess what happens to variable rate mortgages? If you answered ‘rise, after the intro period’, you win. Folks who enter into such agreements fall into a few categories:

1. They know they can afford the artificially low payments during the intro period, but not after. These folks cannot afford that house.

2. They are anticipating rising income to afford the higher, post-intro rates. These folks are incredible risk-takers, and many lose their bets.

3. The rare family banks the difference between the artificially low intro rates and the higher rates. They can afford the higher, but save the difference during the intro period. This is discipline most people do not have.

4. Gullible people that are easily convinced by low intro payments to overbuy. These are unfortunately ignorant folks, that will fall into one financial trap or another, if not many. Foreclosures are rampant with this group.

Credit cards are nothing but a financial tool. But the pain of misusing that tool is quite real. Wanting to buy something NOW, vs waiting to save for it, has its own appeal. And credit card companies are quite good at advertising such convenience! Many such companies send out mass-mailings of offers to apply for their cards, even to those that aren’t terribly credit-worthy. Abusing credit cards may be the single largest cause of consumer financial failure. Some families max out (borrowing to the full credit limit) many cards at a time! Some get so deep into credit card debt, their minimum monthly payments exceed their house payments or apartment rent! But it is a stretch to blame this upon the credit card issuer (bank). Every one of those purchases, and the active cards used to make them, are VOLUNTARY actions of the purchaser.

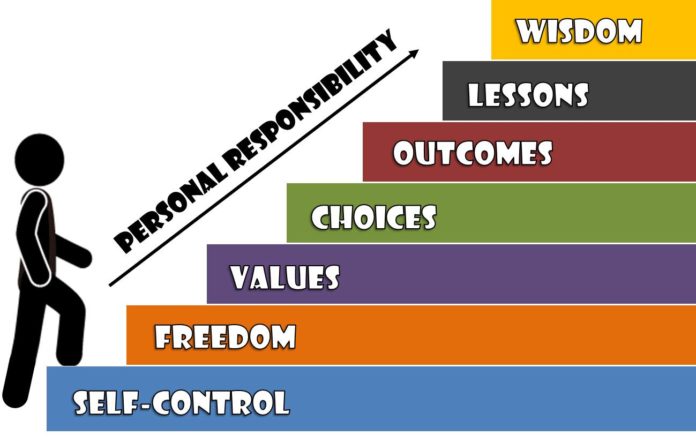

In summary, bankers are service providers, and their products are optional to the buyer. They are not the ‘company store’ of old, that literally OWNED the workers of small towns. How much credit one applies for, or utilizes, is still a consumer’s prerogative. Modern lifestyles, financed by Student Loans, mortgages, car payments, and credit cards, are not compulsory, however common-place they may be. Perhaps personal finance should be a required part of high school, instructing folks the pros and cons of such financial tools. But blaming Mr. Potter (and the banking industry) for any issues regarding such tools is like blaming the spoon because one is overweight.

Thank you for taking the time to read my article! Feel free to add comments (good or bad) in the box below. In addition, there is a link at the bottom of the article to view other items I’ve written at Global Liberty Media. Enjoy!