With riots and looting in several large US cities over the last few months, many businesses large and small will have big decisions coming up. Do they rebuild or relocate? It is not as simple a decision as one would expect. Let’s dig.

Prior to the unrest, the businesses located in NYC, Portland, Seattle, Chicago, and Minneapolis were there for a reason—many of them were corporate headquarters. Those cites were all population centers for entire regions. All five cities’ populations dwarf the remainder of their States—Chicago vs Illinois, Portland vs Oregon, Seattle vs Washington, Minneapolis vs Minnesota, NYC vs New York State.

The prestige of a NYC address carried its own appeal—walk-by visibility to literally MILLIONS of potential customers a year. With anchor activities like Broadway, Wall Street, museums, and world-class restaurants and retail at nearly every corner, drawing millions of domestic and world-wide tourist customers, a NYC corporate was an absolute MUST, especially for customer-facing, financial and investment companies. And the talent pool of available human assets in the NYC and surrounding areas, numbering in the millions, may have been the best in the world. Hedge fund managers, investment brokers, banking specialists of every stripe, shipping and importers, you name it—many of the very best were drawn to NYC. If you can make it there…

Chicago’s Miracle Mile wasn’t far behind NYC’s retail. The restaurant scene there may have been the equal of NYC. Seattle and Portland boast some of the most rustic, scenic, outdoorsy environments; Minneapolis is in the middle of a seasonal Winter wonderland. The corporate giants in Portland, Seattle, and Minneapolis are Fortune 500 household names: Nike, Amazon, Target, Kohls, Starbucks, Nordstroms, Microsoft.

Enter the riots. More ink has been shed about the social justice and political points, so I won’t parrot them here. But the Economics side is just as noteworthy. Consider:

1. Population shift. NYC is losing population at a record pace. Buildings (business and residential) that had years-long waiting lists are now 30-40% vacant. The COVID-19 pandemic forced many companies to allow internet-based work-from-home methods—and productivity didn’t change. So, rather than subject their employees to hours-long commutes, to some of the highest-cost corporate real estate in the world, many have decided to ditch that paradigm. The potential ripple effect of that dynamic cannot be overstated. The riots in the other cities provided another incentive for folks to exit, those that could. Safety is a primary motivator, and many folks decided that, with telecommuting available, proximity to big cities (with their higher real estate costs) just wasn’t as large a need.

2. Change in police methods. Even prior to the riots, Seattle and Portland, along with a few other Liberal-run cities, were relaxing their law enforcement policies, especially regarding ‘overnight camping’, public decency, and drug usage and sale. Tent cities of homeless popped up nearly overnight. Adding gasoline to the fire, many such cities relaxed enforcement of shoplifting, stating that only thefts over $1,000 would be prosecuted. The rise of under-$1,000 shoplifting was as predictable as dawn. The stand-down of law enforcement during the riots changed the stroll to a full sprint. Businesses were looted and burned to the ground, with nary a police presence in sight.

3. COVID-19 social changes. States and cities varied in their enforcement of the social distancing and shut-down methods of avoiding the spread of the pandemic. But nearly all locations either shut down restaurants and bars completely, or forced them to operate at a small percentage of capacity. With a drastic reduction of gross sales, many simply could not afford to stay in business. Coupled with 1. above, the restaurant/nightclub/theatre/movie atmosphere disappeared overnight. The jobs lost, along with their purchasing power, contributed greatly to the population shift. Unemployed simply cannot afford NYC rent.

4. Viable alternatives. Sun-belt cities have been courting corporate giants for decades—some, successfully. The appeal of Nevada, Texas, and Florida—all without State income taxes—is only accelerated by the societal shift. Nearly all have lower real estate costs, and many already have a large talent pool of potential employees. And attracting employees to areas that have minimal or no Winter is not a difficult thing.

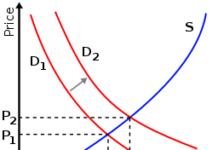

What are the potential long-term impacts of such changes? It could be as minimal as a short-term expense for many to rebuild, maintaining status quo. If the people and ‘scene’ return, all is well. But it could also be as extreme as a death-knell for these cities. In 1960, Detroit had the highest per-capita income in the world. Now…it is Detroit. The largest retailer in the area, Hudson’s, is long gone. 53 years after the 1967 riots, there are still visible destroyed buildings downtown. Nearly everyone that could leave is gone. The Big Three automakers are still there, along with supporting industries, but not much else. Not the desired outcome of any of these other cities. But if the workforce leaves, if the customer base locally shrinks, if the alternatives grow, if the respective ‘scenes’ disappear, there really is no ‘bottom’. The laws of Supply and Demand are very unforgiving. And both Supply and Demand in these cities can simply cease to exist. If that dynamic occurs, Portland, Seattle, Minneapolis, Chicago, and New York City may become shells of their former selves.