Let me tell why unquestionably super-smart market/financial analysts are all very wrong. It was only a couple of months ago when the interest rate yield curve inverted. I’m not going to get into an explanation of the yield curve inversion but it is basically when short-term bonds yield higher rates than long-term bonds signalling “worry” in the bond markets. This brought out all manner and types of professional doomsday predictions and fortune tellers out into mainstream media claiming a recession is “all but guaranteed in the next 1.5 years”. Never mind that the you can correlate recessions in the next 1.5 years with anything but some of these analysts have a 100% track record on being right about major market events like the crash of 2008. However, you are better off with monkeys and dartboards than listening to these professional forecasters/fortune tellers.

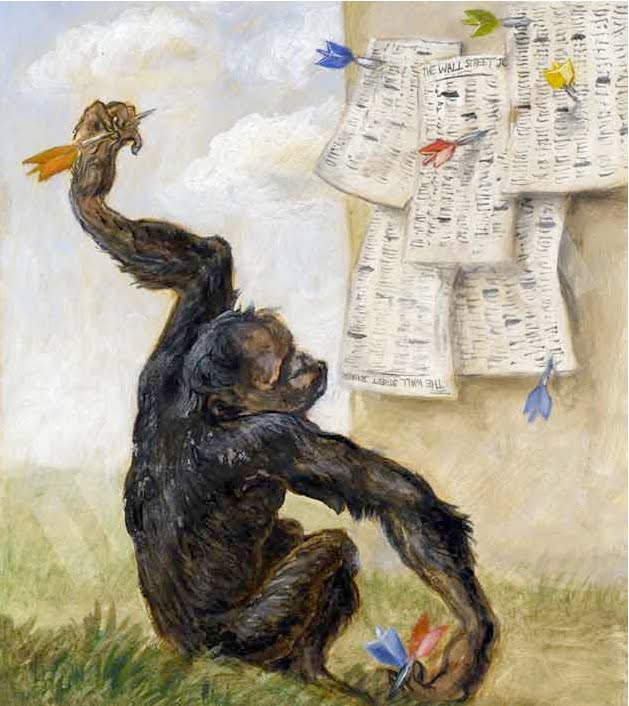

Interestingly, when I did an internet search for non-copyright graphics for this article, I found multiple articles written with this very same thought so the Monkey Dartboard theory appears to be a well-accepted idea. My theory turned out to be not very original…sad. At least it validates my thoughts as others have come to the same conclusion.

Setup

I’ve developed an experiment that helps me to keep things like these doom-and-gloom predictions in perspective. I call it the “Monkey Dartboard” theory of economics. Imagine if you will, placing 1000 trained monkeys into a room with 1000 velcro dartboards. Each monkey is trained to throw multiple velcro balls at a dartboard and each dartboard is covered with a range of potential stock market close numbers. Let’s say this experiment goes on for 1000 days. By the end of the experiment, there will likely be at least one or more monkey that has accurately predicted with 100% accuracy each month’s stock market close over that period.

Do the results make that one accurate monkey a genius? No, just randomly lucky. Will that monkey be able to accurately predict next quarters’ stock market performance? No, the monkey was 100% accurate in hindsight but the knowledge and skill of that monkey to predict the future is based purely on luck. Results in this case is truly no guaranty of future performance as they say.

Don’t Listen to the “Experts”

Just remember that every time you see so-called “experts” interviewed on TV, that they are no different than the trained monkeys from the Monkey Dartboard experiment. In this case there are thousands more monkeys throwing darts and some will tend to be right. However, they are no more reliable than any other monkey at predicting the future. Television news takes advantage of this to boost interest in the day-to-day gyrations of the markets moving on real or imagined market-moving factors. It boosts rating which is what they are trying to achieve. The only thing that matters is every 3 months the earnings and company guidance comes out and that resets the market back to reality.

To be a great investor, you need a successful system that has been proven over time but even Warren Buffet makes big mistakes. The difference between Warren and the rest of us is that he has a solid system for success that he sticks to that works for him.

I did not complete a sentence.. It should read, “…as by the time you have news to bet with, the market has probably already taken that news into account.”

Allow me to add some perspective…

There is some debate over how many stocks one needs to have a diversified portfolio, but there is no question that if you randomly selected fifty stocks, and purchased even amounts of all of them, you would eliminate all risk other than market risk.

It is also a fact that if we assume a perfectly efficient market, then it would be impossible to beat the market consistently, and a diversified portfolio of fifty or more random stocks would be the best investment option possible.

We know however that the market is not perfectly efficient, so it is possible to make more than what the market does if you can bet against inefficiencies. This is what day traders are attempting to do. But that is not as easy to do as it sounds, as by then time

What your monkeys are doing is to randomly select stocks, generating a large, diversified portfolio.